Since COVID-19 hit strict stay-at-home orders were issued by many state officials and employers began to implement work-from-home procedures. We find ourselves working from home, or rather living at work. Any way you slice it, we find ourselves spending much more time at home.

We’re no longer on the road to work with the temptation to stop by the coffee cart downstairs or at the coffee shop that is around the corner from work. After work, the urge to shop as you pass by your favorite stores – home decor and crafts anyone? Next thing you know, you’re pushing a cart down the aisle with a nothing but impulse buys in it. For these and other reasons, individuals are spending less, but are not necessarily maximizing the extra savings they see in their bank account. So before you press “proceed to checkout” on your shopping cart, here’s a list of alternative spending habits you can check out before you confirm that purchase.

Add Dollars to Your Emergency Fund

The pandemic we are facing has highlighted the importance of having an emergency fund to prepare for the unexpected. The purpose of this fund is for exactly that, unexpected emergencies—whether it is a job loss, medical expenses, home or car repairs.

It is recommended to save 4 to 6 months of your monthly expenses in an emergency fund. What is considered an expense?

- Rent/Mortgage payment

- Utility Bills

- Car Payments

- Debt Payments

The list of expenses varies per household, but as you make your list think of any bills and expenses that NEED to get paid next month, then multiply this number by 4, ideally 6. That is the amount you should try to have saved in an emergency fund.

Pay Down Debt

You can use any extra savings to make an extra car payment, mortgage payment or pay down your credit card debt, which in return can help improve your credit score.

Protect Your Loved Ones

I cannot emphasize this enough. We have heard the stories of those unexpectedly losing loved ones due to COVID-19. Make sure you reach out to a life insurance agent to get a free quote; it might not be as expensive as you think. Make sure you protect what matters most.

Max Out Your Employers 401K Match

Are you maxing out your employers 401K match? Not sure what your employers match is? You can find this information on your employee onboarding packet or contract, in your employee portal or by calling your human resources department. This is money available to you that can fund your retirement! Get informed.

Open Roth IRA Account

If you’re already maxing out your employer’s match, consider opening and funding a Roth IRA. You are able to fund your employer sponsored plan such as a 401K or 403B and a Roth IRA. The benefits of a Roth IRA account includes tax-free growth. Earnings on investments are tax-free as long as you hold the account for a minimum of 5 years. However, there is still a 10% penalty if earnings are liquidated before age 59 ½.

The 10% penalty is waived for the following qualifying events:

- College Expenses

- Withdrawal penalties are waived if the funds are used for qualified educational expenses, including tuition, room and board, and books.

- First-Time Home Purchase

- You can withdraw up to $10,000 (lifetime maximum) to pay for a first-time home purchase.

- Birth or Adoption

- You can withdraw funds for qualified expenses related to a birth or adoption

- Medical Expenses

- You can withdraw fund to pay for unreimbursed medical expenses or health insurance IF you’re unemployed.

- You become disabled or pass away

NOTE: The Principal (money you put in) is always accessible tax-free and penalty-free

Save Towards Your Middle to Long Term Goals

If you already have the items listed above covered, then feel free to confirm purchase on your shopping cart. Alternatively, you can fund a middle to long-term goal you may have. This can be to purchase a new car, take that trip you’ve always wanted or save for your children’s, grandchildren’s, niece’s, and/or nephew’s college fund.

I understand that words can only describe so much and when it comes to finances numbers speak louder. Below is an example of an expected return for investing those extra $50 you’re no longer frivolously spending per month.

An individual decides to take those extra $50 per month—normally spent on coffee—and place them into a Roth IRA account. If this $50 a month became a habit and they continued to do this for the next 20 years—with an estimated rate of return of 7 percent on their investments—this individual would save $12,050 over those 20 years and would earn $12,740.78 in tax-free growth.

|

|

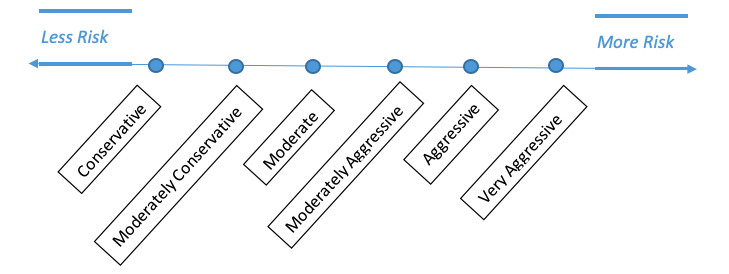

You can click here to plug in your own numbers. Your estimated interest rate will vary depending on your investment allocations, in other words, how your money is invested. A more aggressive portfolio can have a higher estimated rate of return, but with higher returns comes higher risk. A more conservative portfolio offers lower, yet more stable returns with a lower risk. The 7 percent used on the example above is an estimated return on a moderately aggressive portfolio.

It’s easy to feel that this extra money each month could be spent on little luxuries, but it would be wiser to invest in your necessities and financial future.

Cetera Investors is a marketing name of Cetera Investment Services. Securities and Insurance Products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFG STC Insurance Agency LLC), member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. (CA Insurance License#: 0L17443)